26 October 2012

25 October 2012

NIFTY UPDATE FOR 26 NOV

24 October 2012

NIFTY UPDATE FOR 25 OCT

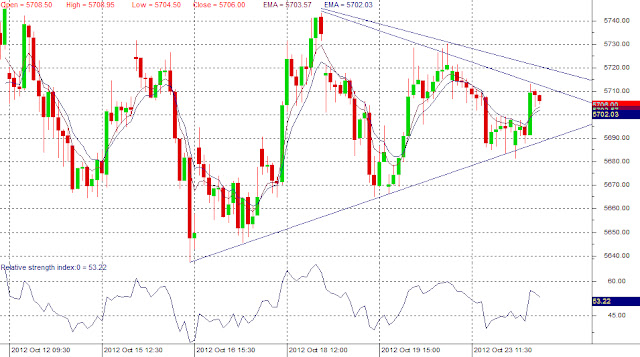

Global trend are turning negative. The S&P 500 broke support at 1420, following a trend channel breakout, both signaling a correction. The Dow Jones Industrial Average similarly broke support at 13300 on the weekly chart. Bearish divergence on EOD charts, Momentum indicates the weakening up-trend. Nifty again took resistance around 5725 on Tuesday. Until It is below 5735 we can't expect up move in the market. New series will start from Friday and I expect a very profitable series in coming Month. Your money can be minimum double or may be triple also in November series. I don't expect too much correction in market from here but 5530 or 5470 may kiss.

Short players can hold Nifty with the stop loss at 5735 spot price. If Nifty sustain more than hour above this level then we can expect a up side target for 5770.

Nifty 5600 put has highest open interest so It seems that market will take support around 5600 level in oct series and correction till 5530 expected to come in next series.

IF YOU REALLY WANT TO EARN MONEY

If you really want to earn money in the stock market, then don't trade in stocks - trade the nifty. Only 250 points per month in Nifty may give you 4 lakh income per Month In just 20 Months.

For all the technical analysis I do, I occasionally trade in stocks future or stocks option. I trade in nifty only.

10 Years of trading experience has taught me one simple thing that it is far easier to take a directional call on the Nifty than individual stocks. If the economy is doing well, the Nifty will anyway perform well and If the economy is doing worse then It will correct any how.

YES, THIS IS RIGHT, TRUE AND TESTED.

If you have been trading since two or more than two years and earned nothing till now or your fund didn't growth according to your expectation. Well I would like to suggest you made a proper strategy, and don't trade yourself if you don't know how to trade otherwise you will washout your all money in few months and some time in weeks also. I have a strategy which may take you from 1 lot to 32 lots in just 20 months, and your income will be 4 lac( 400000) per month after 20 months. First trade only in Nifty future. Nifty future has enough liquidity to trade. Don't think about any stock trading or option trading.

HOW WILL POSSIBLE RS. 4 LAC PER MONTH ?

Lets understand

Only 250 points per month in nifty future may take you to 32 lots in just 20 months.

How?

Lets understand this with a table below. I have made it of each 4 months slab.

MONTHS-LOTS- CAPITAL- POINT/LOT- INCOME/PM

0 to 3------01--------50000-----250 x1=250 -----12500.00

4 to 7------02----- --100000 ---250 x2=500------25000.00

8 to11-----04--------200000----250 x4=1000--- -50000.00

12to 15----08--------400000---250x 8=2000----100000.00

16 to 19---16--------800000----250x16=4000----200000.00

20 to 23---32-------1600000---250x32=8000----400000.00

200-250 points may gain every month easily without doing hectic and aggressive trading. Without taking too much risk of your capital. Small investors who come into stock market by carrying a dream that they will earn money, but happens just opposit according to ones expectation. This plan is famous among them in India. It is liked by thousands of people and even subscribed by hundreds of people who don't know how to trading. Protect your capital first and learn how to earn handsome money.

This is the only plan which may take you upto 4 lac per month income in just 20 Months with investment of Rs.50000.00 only.

There are lots of advantages of trading the nifty:

All good and bad news reflect nifty.

We can play both sides of the market and take profit from rallies both side.

Low brokerage, Excellent liquidity, Low volatility, no heavy swings and It need Low investment also.

SUBSCRIBE FOR GOING 1 LOT TO 32 LOTS IN JUST 20 MONTHS.

SUBSCRIPTION RATE

MONTH OUR PRICE OFFER PRICE SAVE PRICE AVERAGE PRICE/PM

1 2500/00 2000/00 500/00 2000/00

3 6500/00 5100/00 1500/00 1700/00

6 12500/00 9000/00 3500/00 1500/00

12 24500/00 14400/00 10100/00 1200/00

TO AVAIL THIS OFFER SUBSCRIBE TILL 25 OCTOBER. AFTER 25 OCTOBER NO OFFER WILL BE GIVEN.

BANK DETAILS ARE GIVEN BELOW ON THIS HOME PAGE

23 October 2012

LIVE MARKET UPDATE

22 October 2012

NIFTY X-RAY REPORT FOR 23 OCT

MONDAY PRE MARKET UPDATE

Disclamer:-

Futures and Options trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the Futures and Options markets. Don't trade with money that you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell Futures or Options.

The contents of this site are for general information purposes, only. The strategies/plan discussed above in this thread/site is made by me based on data which is operated and maintained by third parties. However it is tested and proved every attempt has been made to assure accuracy, but it is by me only. We assume no responsibility for errors or omissions. Examples on this site and in the manual are provided for illustrative purposes and should not be construed as investment advice or strategy. The future data manual is for informational purposes only. These predictions/tips are technical , based on charts conditions ONLY. This is only a guideline, the decision has to be taken after logical thinking by you. Technical analyst and astrologist will not be liable for any personal or financial losses or profits.

The information and views in this website & all the services we provide are believed to be reliable, but we do not accept any responsibility (or liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most.